VAT - Where do you stand?

There are two things in life that are certain: Death and Taxes

Navigating the VAT minefield

There still seems to be some confusion of when and if a yacht is liable to pay VAT. While this is an expansive topic and not one I can easily condense, hopefully this blog will clarify a few mis-understandings. Please bear in mind the information in this blog is written with the sale of alcohol in mind, other products and services may be liable to different rules.

What is VAT?

VAT is a consumption tax added to a product's sales price. It represents a tax on the "value added" to the product throughout its production process. Ultimately the consumer bears the burden of the VAT, so the more you spend the more tax you pay.

It is very important to note that avoiding VAT is classed as tax evasion and the punishments can be punitive. If you have, for the sake of our article, boarded wines without paying the VAT or having the correct paperwork, the boat can be arrested.

In a recent case the local customs agents found a yacht to have evaded paying VAT on a small order of alcohol. The punishment was charging the owner VAT on EVERY item on board and the yacht itself. Not a good position to be in!

VAT, Yachts and Wine

Let's start with the assumption that every yacht is liable to pay VAT on their wine and spirits orders. As alcohol is a controlled substance the regulations are far tighter and much more difficult to circumvent.

Essentially there are only three ways to qualify for zero rated VAT orders.

Export

Orders delivered to the Yacht outside the EU. For example all orders to Antigua would qualify for a zero rate of VAT. If the wine re-enters the EU, the boat will have to declare this. This is the same exemption that airports use to sell you duty free cigarettes and alcohol.

Inter community

This is for business to business orders between two VAT registered companies in different member states of the EU.

If your vessel has a valid EU VAT number, and is outside of the sellers country. For example the boat would have to be in the EU in any country apart form France for you to qualify for a zero rated VAT delivery from Onshore Cellars. If you have a valid French TVA number we can still deliver your order and you will be able to claim your VAT back from the French on your VAT returns.

Charters

“I am commercially registered so I don’t pay VAT.”

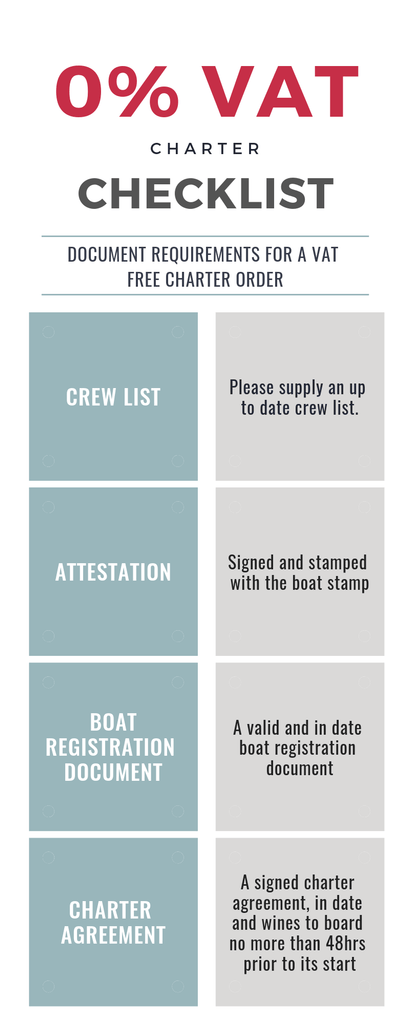

I hear this every day, and to put it simply this is not true. To qualify for a VAT exempt order you have to meet a number of requirements. You must meet all of these conditions.

1. Commercially registered

Your vessel must be registered for commercial use as a charter vessel

2. A valid charter agreement

You must have a valid charter agreement, and the wines ordered must be consumed on the charter. The wines can only board the vessel 48 hrs prior to the charter and the vessel must leave the port within 48hrs. So no static charters!

3. Crew list

Provide an up to date crew list for the time of delivery

4. Signed attestation

It is very important to read this prior to signing, as the customs agents are now checking log books to make sure your vessel was out of French waters for at least 70% of the time the previous year.

Once we have all of this, we can then contact our customs agent who will take up to 48hrs to process the correct paperwork. The customs in the delivery port has the right to be present at the time of delivery.

Final warnings

To finish, it should be noted that if you are uncertain about any of the requirements, then seek advice from your management company or accountant. Be very cautious of any company offering VAT free deliveries without supplying you with the correct clearance forms. You will be held liable, and while we all like to save the owner money, no one wants to have to explain why the boat has been arrested to the dock.

Also, it is illegal to remove wines from the yacht that have not had the VAT paid. If you are caught by customs, expect hefty fines!

Make no mistake, the days of not paying VAT on yachts are drawing to an end. Make sure you do not land yourself in hot water.

This is about as simple as I can make it! But if you have any questions I am happy to talk further.

Leave a comment